Investigation period/responsibility

- Survey period: August 3, 2020 (Monday) to August 25, 2020 (Tuesday)

- Person in charge: Marketing Division Sales Partner Div. SY

Research motivation

By chance, I was assigned to be in charge of two types of product sales affiliate programs (two types with and without restrictions for the same product).

Looking at the number of affiliation applications from affiliates, those who do not want to be bound are overwhelmingly popular.

This is the media's assumption that ``general consumers will prefer programs without restrictions, which means that programs with no restrictions will have a higher CVR.''

On the other hand, it goes without saying that "regular purchase" is preferable from the advertiser's perspective.

This difference in perception between media and advertisers remains deep-rooted.

In addition, the author acknowledges that there are sections in which he has not been able to explain the merits and demerits of the ``periodic binding policy'',

I write to deepen my knowledge in this R&D.

Observation of regular mail order "tied model" and CVR, LTV

In the first place, the “binding model” is

It is a sales model in which ``in exchange for regular mail-order products being offered at a cheaper price than the list price, customers are promised to continue selling for a certain period of time.''

While the "binding model" in regular mail order has brought stable profits to e-commerce businesses,

This results in frequent undesirable troubles such as receiving complaints from purchasers.

The customers that e-commerce businesses (advertisers) acquire through this “binding model” are

Because you will always continue to purchase the product a certain number of times,

This means that you are guaranteed a profit for each customer you acquire.

Although there are certain results in numbers such as LTV (customer lifetime value) by retaining customers for a certain period of time by adjusting the initial price,

The inherent problem is that it is difficult to build win-win relationships with customers who do not like to be tied down.

The merits of the EC business side are not only that,

``It makes it easy to calculate profits such as ``what is the gross profit'' against the advertising expenses required to acquire new customers, and the predictions are highly reproducible.''

This can be said to be an unexpected measure for e-commerce businesses.

However, in recent years, this "binding model" has been viewed as a problem by the Consumer Affairs Agency.

Although this "binding model" is unexpected for e-commerce businesses who spend large amounts of advertising money to acquire new customers,

By reconsidering the model where troubles are constantly bound, and making full use of other measures without any constraints.

Even if the LTV has fallen, we are beginning to see a trend of acquisitions that will eventually secure sales.

I would like to introduce this in the second half.

In the next section, I would like to consider "LTV" and "CPA", which are indicators for calculating advertising costs.

LTV calculation

Generally, LTV is an abbreviation for “Life Time Value” and refers to customer lifetime value.

It is a well-established theory that it is calculated using the following formula.

[LTV=Average purchase unit price × Average purchase frequency × Average purchase period]

However, to be honest, there are many aspects that are difficult to understand.

Therefore, we analyze LTV with the following interpretation

(1) LTV of the entire shop

= [total sales / number of purchasers]

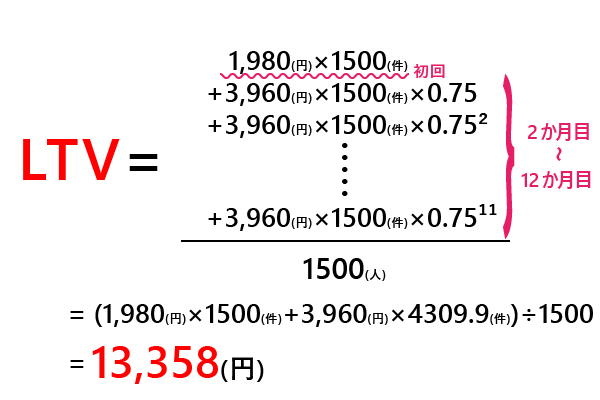

⑵LTV for each product

= [{(Initial price x number of purchases in the 1st month) + (regular price x number of units remaining in the 2nd month) + ... + (regular price x remaining price in the 11th month) + (regular price x remaining price in the 12th month) Number of purchases)} / Number of purchases in the first month]

Regarding (1), a simple calculation is sufficient.

As for ⑵, the calculation is complicated because the initial price and the second and subsequent prices are different.

Also, if you want to calculate past LTV, you can use past numbers, but

When calculating future numbers such as simulations, the concept of ``industry average repeat rate'' is necessary.

As an example, let's calculate the LTV under the following conditions.

*For simplification, we consider the "total amount paid by one customer for one product in one year (=12 months)" as LTV.

New customers acquired in the second and third months are excluded from the calculation.

・1,980 yen for the first time, 3,960 yen after the second time

・Industry average repeat rate 75%

・Aim to acquire 1500 new customers every month

・Send one product every month

Applying this condition to formula ⑵, we get the following.

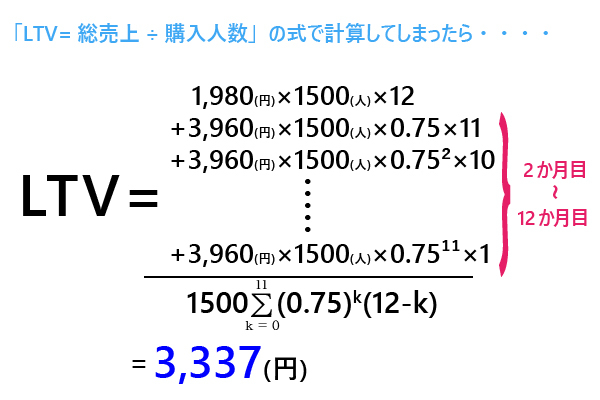

However, if the above calculation is performed according to (1) the LTV of the entire shop, the LTV figures will differ.

Since it also includes new customers acquired from months 2 to 12, the LTV will be quite low.

(See figure below)

Calculation of marginal CPA

Also, the limit CPA can be obtained from the calculated LTV.

Limit CPA is "the maximum amount of money you can spend to acquire new customers for regular products"

Exceeding this will result in a deficit.

The limit CPA is calculated by the following formula.

[Limit CPA = LTV / Gross Profit Margin]

For example, with a product with a gross profit of 40%,

If you calculate the limit CPA with the same formula for "LTV: 13,358 yen" and "LTV due to miscalculation: 3,337 yen" obtained above

The prices are 33,395 (≒ 34,000) yen and 8,342 yen, respectively.

Based on this, the optimal CPA (performance fee amount) is calculated and serves as an indicator for advertising measures.

If you make a mistake in this calculation, even though the original acquisition cost can be up to 30,000 yen as advertising expenses,

The promotion will be limited to 8,000 yen or less, and it will be a bumpy road.

Efforts to secure profits without binding

As mentioned above, the binding model is

While there is no problem as long as it is sold under the customer's understanding,

Consumer Affairs Agency guidelines require detailed explanation of sales conditions.

In response to this, some businesses have recently begun to break away from the restrictive model.

Until now, we will stop tying up what was holding customers with contracts,

Efforts to encourage customers to voluntarily continue regular use have recently become a hot topic.

Customers will be freed from inconvenient contracts and will be able to shop better,

As an e-commerce business operator, we are moving forward from a model that is prone to problems and are beginning to evolve further.

By discontinuing the restrictive model that had the advantages of ``ensuring LTV'' and ``high reproducibility of gross profit forecasts,''

What impact will it have on your business? can be said to be the focus

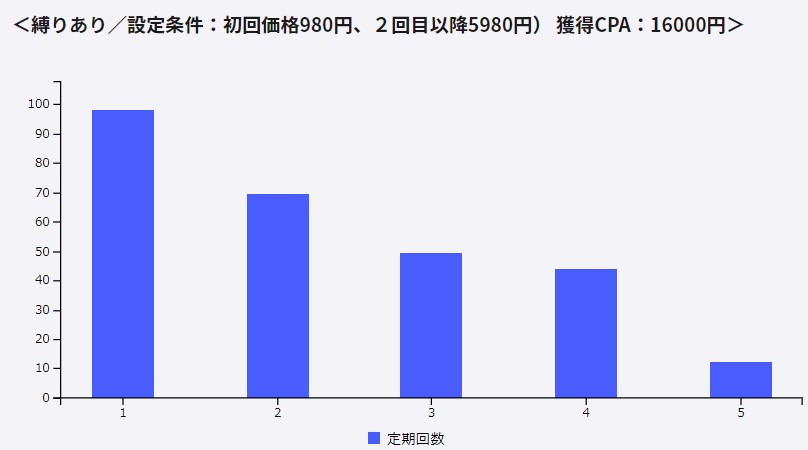

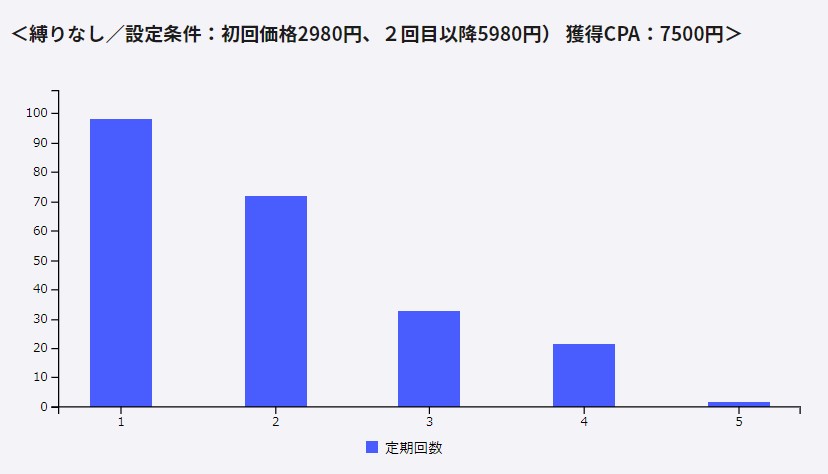

Therefore, based on the case of a cosmetics-related site that converted from a tied model to a non-tied model,

Let's compare the degree of influence of CPA and LTV.

Below, graphs with and without binding will be compared in parallel.

Initial price... (with binding) 980 yen, (without binding) 2,980 yen

Regular price … (common) 5,980 yen

From the above figure, it can be seen that the LTV decreases by switching from the model with ties to the model without ties.

So far, it seems that the benefits of having a tie that the advertiser had assumed were simply lost.

However, on the other hand, the sales site represented in the graph

Properly specifying the restrictions raised the purchase barrier for users, leading to a decline in CVR.

As a result, in the case of a tied model, the acquired CPA will be high.

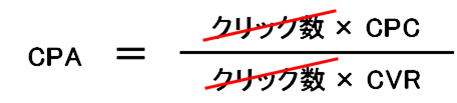

*When calculating the “cost” and “number of CVs” in listing advertisements

・Cost = number of clicks x CPC

・Number of CV = Number of clicks x CVR

It is calculated by simple calculation.

At this time, the acquisition cost (CPA) is "cost / number of CV",

By removing the numerator and denominator clicks from consideration, we have the relationship CPA = CPC / CVR.

(See figure below)

Back to the topic.

The fact that ``CVR has decreased due to specifying the binding''

Since the denominator in the "CPA = CPC / CVR" relational expression has simply decreased, the CPA has skyrocketed.

Conversely, by pushing the shibari nothing as a selling point,

I would like to focus on the fact that even if the initial price is increased by 3 times, it has succeeded in significantly lowering the acquired CPA.

Even if the LTV decreases, it can be considered that by lowering the acquired CPA, the balance is balanced as a result.

If the final profit can be secured, this can also be said to be one of the strategies as an EC business.

consideration

This time, I have mainly focused on "changes in LTV and CPA due to product pricing design and the presence or absence of restrictions."

Many sales activities begin with some kind of ``request'' such as ``the offer price is XX yen.''

Here, by questioning the premise of ``Is the numerical setting really appropriate?''

I think it should be possible to explain on the basis of the basis for raising advertising costs.

For e-commerce businesses

“What is the (industry average) repeat rate?”

“What will be the profit margin?”

After repeated interviews, we propose an appropriate advertising budget and draw a plan for acquisition.

I myself would like to keep this in mind in my future sales activities. I feel this is the case and write it down here as a review.

reference